Covenant Lite #20: Does Size Really Matter in Private Credit?

Analyzing the Risk/Return of Small vs. Large Managers

If you've ever sat through an investment committee pitch for a private credit fund, you've likely heard heated debates on fund size: "Are bigger platforms safer bets?" "Do smaller managers deliver outsized returns?" As an allocator to private credit, I've wondered the same. Armed with the latest data from Preqin, I dove into the numbers to see if size truly matters.

How I Got the Data

I sourced comprehensive performance data from Preqin, focusing exclusively on direct lending managers globally to capture a broad investment universe. To ensure reliability, I focused on funds with vintages from 2011 to 2020—given that newer vintages' IRRs aren't yet fully baked.

The dataset included 437 managers, neatly divided by fund size:

Tiniest Funds: <$100 million

Small Funds: $0–500 million

Midsized Funds: $500 million–$1 billion

Big Funds: >$1 billion

Here’s What the Data Showed…

Performance Comparison by Fund Size

Median Net IRR by Fund Size

The smallest funds (<$100 million) posted the highest median Net IRR at 10.8%, comfortably outperforming larger groups. Midsized and big funds ($500 million–$1 billion and >$1 billion respectively) offered somewhat lower returns, clustered around 8.8–8.9%.

Median Net Multiple by Fund Size

In line with IRR findings, smaller funds typically showed higher multiples (TVPI), indicating slightly stronger performance potential compared to larger counterparts, but with higher variability (discussed next).

Volatility and Risk Considerations

Dispersion and Volatility by Fund Size

While smaller funds deliver higher returns, they also come with significantly greater volatility, showing nearly double the dispersion of returns (standard deviation of 7.7 percentage points) compared to big funds (3.2 percentage points). This suggests that bigger funds offer steadier, though potentially lower returns.

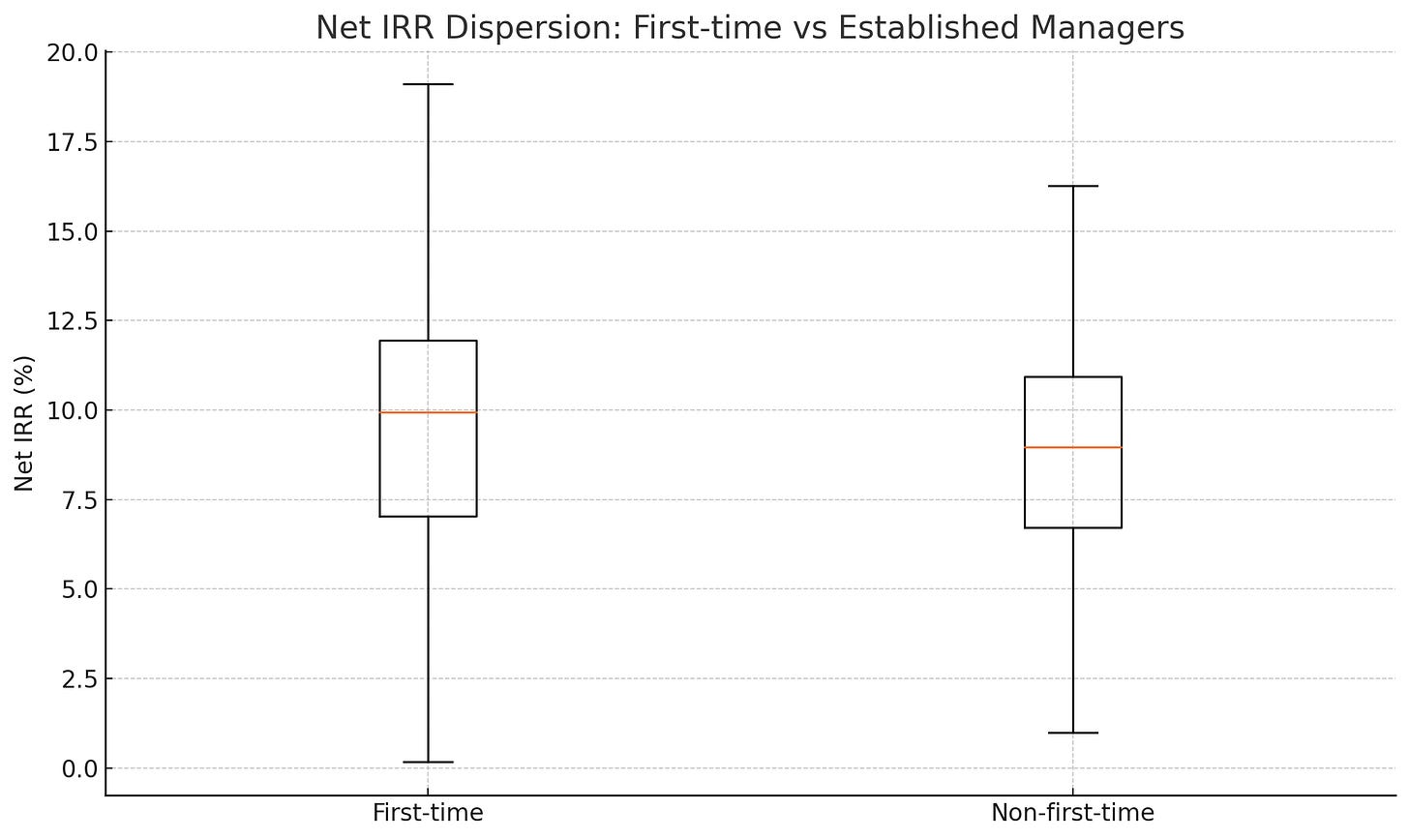

First-Time vs. Established Managers

IRR Comparison

Interestingly, first-time fund managers slightly outperformed established peers, offering median returns of 10.0% compared to 9.0% for experienced managers.

Net Multiple Comparison

First-time managers and established funds produced largely identical multiples, perhaps suggesting quicker distributions (which benefit IRR but do not affect multiple).

Dispersion and Volatility

While first time funds delivered higher returns, they did so with significantly more volatility than established funds.

Allocator Takeaways

Small funds: You can generally make higher returns investing in small funds, but there is higher dispersion and you have to avoid the losers.

Larger funds: Generally a safe bet, but you do sacrifice some return by going with the established names.

First-Time Manager Exposure: First time funds can be lucrative—especially if you negotiate advantageous fee structures—but higher dispersion means you need to find the right group to back.

Bottom Line

Size does matter—but not simply as "big is safe" or "small is risky." Effective allocation requires a nuanced approach, factoring in risk tolerance, liquidity needs, and active relationship management.

These takeaways were not surprising to me—my group focuses on emerging managers—but would be curious if any readers had any thoughts.

Covenant Lite