There a number of players in the private credit universe, all of whom approach the market in their own way. Golub is known as the benchmark is vanilla direct lending. Oaktree made their reputation in distressed. Fortress pioneered niche areas of private credit like litigation finance and aircraft leasing. Today, I want to focus on Apollo Global Management, a group known for being more forward-thinking (and aggressive) than its competitors.

Apollo has been at the forefront of a number of trends in private credit. They were early to see the opportunity of raising insurance capital to deploy into private assets. Today, these assets make up a significant chunk of their AUM through their Athene subsidiary, enabling them a cost of capital advantage that has helped them scale into a number of areas of private markets. They were also early players in distressed credit, developing a formidable reputation as loan-to-own pioneers. However, their new gambit is decidedly less sexy on its face: providing private credit to investment grade companies.

Apollo's Definition of Private Credit

To listen to Mark Rowan, the CEO of Apollo, tell it: most of his competitors are thinking too small when considering the potential of private credit. In his mind, virtually everything a bank has historically done can (and likely should) become the province of private credit over time.

“Credit only comes from one of two places. It can come from the banking system, or it can come from the investment marketplace. In the investment marketplace, it can come from sources that we know very well, so bonds. ... Or it can come from institutions -- private credit. Private credit -- in your newspaper, as well as others, people think of it as direct lending. When in actuality everything that would be on a bank balance sheet is private credit…” – Mark Rowan, Nikkei Asia, July 16, 2024

Using this definition, the “Total Addressable Market” of private credit becomes HUGE. Rather than $3 - $5trn as estimated by others like BlackRock, it becomes closer to $40 trillion. Part of the reason why the TAM expands so massively is because it increases the eligible borrowers to include the most creditworthy, investment grade types – who were traditionally serviced by banks (or capital markets) but who might want to take advantage of the speed, certainty and flexibility offered by private markets.

In order to capture this prize, Apollo has been orienting its business increasingly towards credit over time. While known as a private equity shop, credit makes up the vast majority of their AUM today.

Per CEO Mark Rowan, "The asset management business ended 2023 at $650 billion, approximately $500 billion of which was private credit, mostly investment-grade" This isn't just some niche corner of the market; it's a huge, diverse space that is becoming increasingly important.

They break down the key segments of private credit into a few main categories:

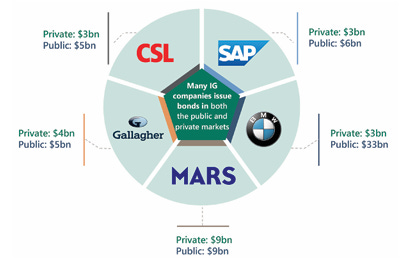

Investment Grade Private Credit (Private IG): This segment has grown beyond just corporate private placements to include asset-backed finance (ABF) and bespoke corporate financing solutions. Apollo views Private IG as an overlooked area with the potential to boost returns in fixed income portfolios. They believe that the old idea that private investments are inherently riskier than public is outdated, as many of the largest public investment-grade bond issuers are also participating in the private credit markets.

Asset-Backed Finance (ABF): This is a critical tool for funding the day-to-day activities of businesses and consumers globally. ABF includes a wide range of credit types like residential mortgages, credit cards, student loans, auto loans, and even financing for things like planes and entertainment royalties. The ABF market is large and diverse, with a history of lower losses than corporate credit, making it an appealing option for investors.

Direct Lending: While Apollo is active in both the investment grade and asset-backed space, they are also involved in direct lending to larger businesses on a senior secured basis, aiming to capture excess spread while carefully managing risk. This strategy emphasizes lending to established companies with solid business models, reducing reliance on more risky corporate borrowers or subordinated debt.

Comparison Between Public Credit and Private Credit

The conventional wisdom used to be that public markets were safe, while private markets were risky, but Apollo believes that this distinction no longer rings true. They argue that the lines between public and private credit are blurring, and that both carry increasingly similar risk profiles.

On risk, they point out that many of the same large, investment-grade companies that issue public bonds are also tapping the private credit markets. It would be difficult to argue that one market was inherently riskier than the other if the underlying borrowers are becoming increasingly similar. They believe the two markets are converging.

Indeed, given less competition, private deals tend to be structured more favorably from a creditor’s standpoint, which may reduce risk. Private credit deals are typically negotiated bilaterally, allowing lenders to secure stronger legal and contractual protections. Private lenders can be more selective, defensive, and focused on credit documentation. In contrast, public deals are often more standardized and less flexible.

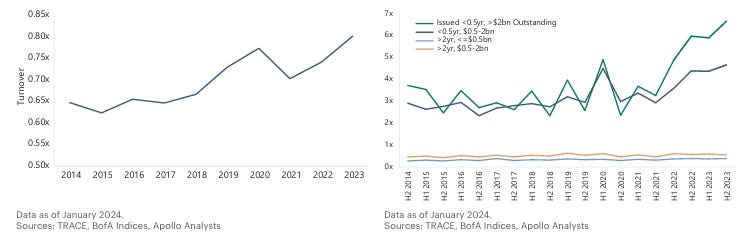

Public markets are often thought to be more liquid, which should be a risk mitigant because investors can sell out of underperforming exposure if they want – in contrast to private credit where they are typically stuck with their investment until maturity. But Apollo notes that liquidity is not always what it seems. They point to increasing fragmentation and higher transaction costs during stress in public markets. As you can see in the graph below, public bonds older than 2 years have limited turnover – meaning that holders would likely have to seek a discount if they sold. Also, the spread between small and large public bond issues has compressed, which is an indication that investors aren't being paid as much for taking on illiquidity in the public markets.

Benefits of Private Credit for LPs

So, why is investment grade private credit so appealing? Apollo highlights several key benefits:

Higher Yields: Private credit offers higher yields than comparable public market instruments. Private IG can offer a spread premium of 100-200+ basis points over comparable public deals due to the complexity and origination involved. Direct lending also offers attractive risk premiums and all-in yields compared to public markets.

Diversification: The private credit universe offers strong diversification across different sectors, risk profiles and types of borrowers. ABF, in particular, has diverse pools of underlying assets.

Downside Protection: Private credit often comes with structural safeguards, such as contractual cash flows, self-liquidating structures, protective covenants, and legal separation of assets in securitizations. These features can protect lenders from losses.

Apollo's Approach to Private Credit

Apollo isn't just dipping their toes into private credit, they're diving in headfirst. Here's a look at their approach:

Expertise: Apollo emphasizes strong credit underwriting, financial analysis, structuring, and servicing as critical to success in private credit. They have a strong expertise in evaluating and managing complex credit structures.

Origination: They are building out their own origination capabilities and seek to control proprietary deal flow. This allows them to create customized solutions that meet the needs of both borrowers and investors.

Focus on Quality: Apollo focuses on lending to larger, more established businesses on a first-lien, senior-secured basis. This approach is designed to provide downside protection and a higher priority of claims on assets.

Strategic Partnerships: Apollo sees private credit as a collaborative partnership with banks rather than a competition. In fact, they are partnering with several banks to expand their reach in private credit.

Coexistence of Public and Private Markets: Apollo believes that both public and private debt markets will continue to grow and coexist. They don't see it as an either/or situation, but rather a menu of different credit solutions for borrowers.

In conclusion, Apollo is clearly a big believer in private credit. They see it as a large, diverse, and growing market with a lot of potential for both borrowers and investors. They are leveraging their expertise and experience to build a strong presence in this space and see it as an enduring opportunity that's here to stay. They are a formidable player going for scale in a market that is increasingly dominated by the largest groups.