Covenant Lite #10: An Introduction to Asset-Based Lending

The next wave of private credit growth or a false pretender to the throne?

In the world of private credit, cashflow lending is the 800-pound gorilla. Estimates vary, but Preqin and Pitchbook generally consider cashflow lending funds to make up 60-70% of total private credit assets raised and/or deployed. But a new challenger to cashflow lending’s dominance has emerged in the form of asset-based lending. Groups like Apollo think that asset-based lending could ultimately become as large or even surpass cashflow lending in terms of total invested capital by private credit managers over time (Link).

But what is this upstart strategy? And are its ambitions simply delusions of grandeur or are they based in substance? I’ll cover that in this post, so read on to find out!

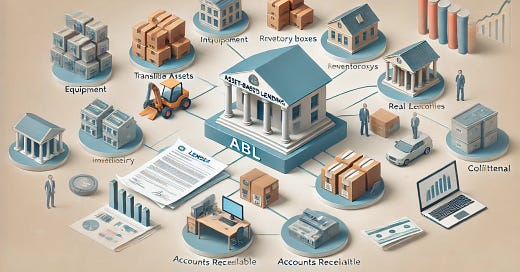

First, some definitions for my newer readers. Cashflow lending, as per the name, involves lending to companies that are generally profitable, where the lender lends against a borrower’s expected future cashflows. Asset-based lending, in contrast, involves lending backed by specific tangible or intangible assets as collateral. Borrowers that seek an asset-based loan versus a cashflow loan might be those with valuable assets but uneven or uncertain cash flows—such as businesses facing short-term liquidity issues, cyclical industries, or fintech companies needing leverage against their loan portfolios.

Providing loans to companies like this used to be the province of banks, similar to cashflow loans. If you want more context on this, check out my initial article on the History of Private Credit (Link). However, regulation has made even this type of lending, which in many ways is “safer” than cashflow lending, overly punitive from a risk-weighted assets perspective for banks to hold on balance sheet. As a result, private credit funds are stepping into the void, similar to how they did with cashflow lending more than a decade ago.

With the playbook in hand from the initial rise of private credit, the top firms are frantically attempting to stake their claim to what they think could be the next wave of growth in private credit. Many have built dedicated asset-based lending teams in the last 1-2 years. For example, Apollo launched an Asset-Backed Credit platform and appointed new co-heads to grow the strategy, and Blackstone created its “Asset-Based Credit” group in 2023 (Link). In fact, 5 of the top 30 U.S. private credit managers launched their first asset based lending funds in 2024, and in a recent survey 58% of private credit manager said they will prioritize an asset based lending strategy in 2025 (Link).

This reflects a broader recognition that asset-based lending is a massive space (the private asset based lending market is potentially multi-trillion in size) yet still under-allocated by investors. Firms with the specialized capabilities to source and manage asset-backed deals might enjoy a competitive edge in a market with higher barriers to entry than cashflow lending.

It also reflects a broader realization amongst private credit managers that we may be reaching the limits of growth in cashflow lending. Recent headlines that the private equity industry shrunk for the first time in decades seemingly validate this notion since PE buyouts have been the principal user of cashflow loans for more than a decade (Link).

But what are the strategies that the funds going after the asset-based lending market employ? Generally, they fall into one of three buckets:

Bank Replacement: Filling the gap for companies traditionally served by banks

Financing the New: Financing fintech loans or other new asset classes

Opportunistic Lending: Providing a lifeline to distressed or “out-of-favor” companies

Bank Replacement:

This is the biggest of all the different strategy types, with the most growth potential. As a result, this is where the behemoths of the industry such as Ares, BlackStone and Sixth Street are focusing their efforts. The strategy involves lending to (generally) healthy middle-market companies that previously relied on bank credit lines (like revolving credit facilities or inventory loans). As banks pull back, private credit funds are stepping in to provide these routine working capital loans on a bilateral basis. Often structured as revolving borrowing-base facilities secured by receivables and inventory, these loans give companies the liquidity once provided by commercial banks.

Banks’ retreat from smaller and mid-sized borrowers (due to refocusing on larger clients and higher compliance costs) has left many solid businesses searching for credit. Private lenders are capitalizing by offering asset-based loans to “main street” companies in need of working capital or growth capital. In many cases, banks themselves are referring sooner than before if a borrower falls outside new bank criteria.

But it is not just commercial loans. Certain groups are getting into consumer lending too, striking deals to finance everything from credit card receivables to auto leases in private transactions. Blackstone, for instance, teamed with banks in 2024 to acquire a $1 billion portfolio of credit card receivables (from Barclays) as well as a $1 billion infrastructure loan portfolio from Santander.

This trend has turned asset-based lending into a core strategy for direct lending funds that want exposure to asset-backed corporate loans (often with a senior secured, floating-rate profile similar to bank loans but executed privately). Return targets for funds in this area are generally 8-12% net on an unlevered basis. Levered versions target higher returns of 10-14% net based on what we’re seeing.

Financing the New:

Asset-based private credit also extends to financing pools of consumer and specialty loans – an area where fintech lenders and non-bank finance companies seek funding. Large asset managers have been arranging forward flow and “warehouse” facilities to buy or lend against these loan portfolios. A prominent example is Sixth Street’s partnership with Affirm (a fintech consumer lender), in which Sixth Street will purchase up to $4 billion of Affirm’s point-of-sale consumer loans over three years (Link). Similarly, PGIM provided an initial $500 million to acquire Affirm’s loans, complementing its investments in public asset-backed securities (Link).

These deals effectively replace the public ABS market or bank lines with private capital, often via “rediscount” facilities or asset acquisitions. Such strategies allow fintech originators and specialty finance firms to continue lending (by offloading loans to private funds), while investors earn attractive secured returns. This has become a key growth area for asset-based lending, blurring the line between private credit and structured finance. As Apollo’s co-head of asset-backed finance noted, the asset-based lending market spans everything from “credit cards and student loans, to planes, trains, automobiles, and more,” and tapping these consumer and equipment assets is a natural next step for private credit (Link).

Net return targets in this area are slightly higher than in the pure bank disintermediation strategy, generally 10-14% net.

Opportunistic Lending:

Opportunistic asset-based lending involves providing secured loans to companies facing financial challenges, operational distress, or temporary liquidity shortfalls. This strategy is often referred to as "lender of last resort" lending, as companies turning to these funds typically cannot secure traditional bank loans or cash-flow-based private credit due to weak financial performance, negative earnings, or uncertainty about future profitability.

Funds following this strategy lend primarily based on the liquidation or intrinsic value of the borrower's assets, rather than the borrower's ability to generate consistent cash flow. This type of lending is especially prevalent during economic downturns or industry-specific cycles, when businesses in challenged sectors struggle to secure traditional financing.

By focusing on collateral and structuring creatively, these opportunistic asset-based lenders can charge higher yields and often perform well even when the economy is under stress (when many businesses can’t access traditional capital). This rescue lending approach uses asset-based lending principles to serve distressed or undercapitalized companies – a niche historically filled by distressed debt investors, but now increasingly by direct asset-based loans.

Given the extra risk in this area over the other two asset-based lending strategies, net return targets are higher: 11-15% net on an unlevered basis and up to 20% if leveraged.

In summary, there are a number of different approaches to asset-based lending, offering allocators an alternative to cashflow lending strategies that likely make up the bulk of their fund allocations. Groups like Ares, Blackstone, Sixth Street and others see asset-based lending not just as complementary, but potentially larger than cashflow lending over the long term — and I tend to agree. The TAM of the market is huge even on the low end of the range of estimates, LPs are clamoring for ways to diversify their private credit allocations, and the lower competition (at least at this point) offers the potential for higher returns than cashflow lending. Watch this space.